The electronics industry is always changing and evolving. This year has already been eventful and it’s only Q1. Here’s what is on the horizon for the rest of the year-

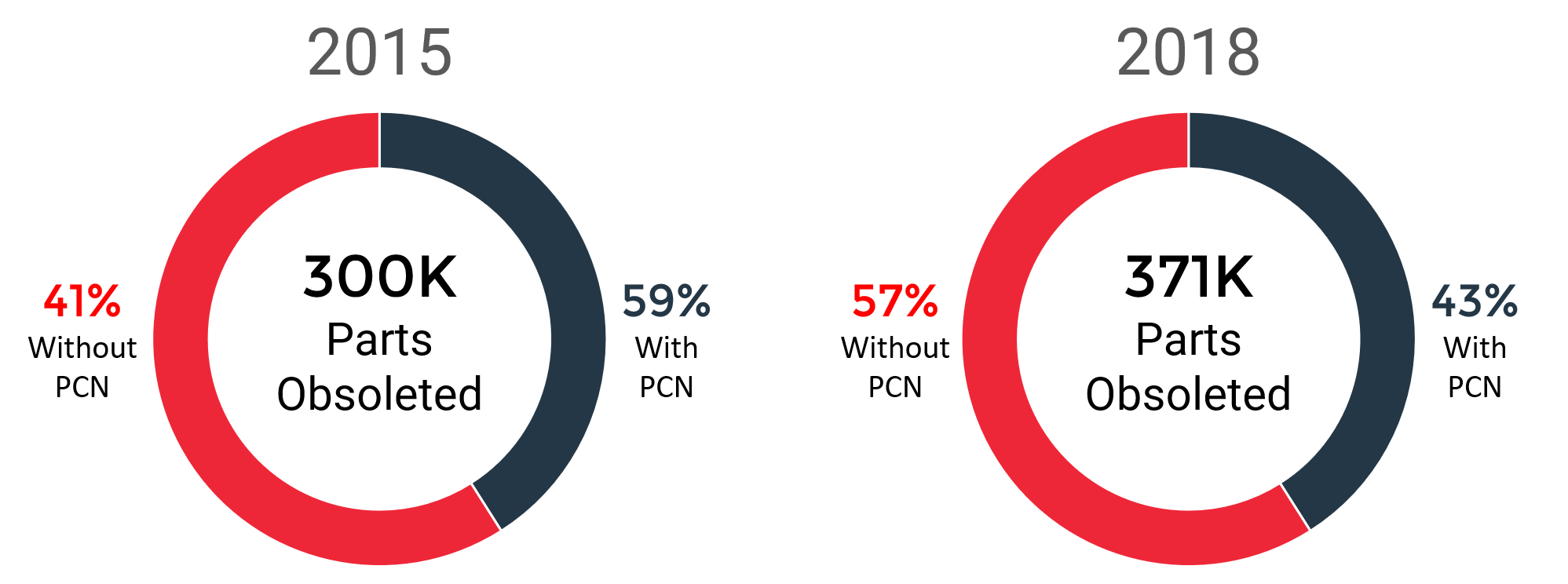

Product Changes Without Notification

PCNs may be released by an electronics manufacturer for a variety of reasons but obsolescence notices are not always sent. From 2015 to 2018, parts obsoleted without a notice has jumped roughly 15%.

Last Time Buy (LTB) announcements with an effective date of ‘immediately’ have also become a more common occurrence. PCNs with immediate LTBs were at 20% in 2015 and 28% in 2018. SiliconExpert, a company that keeps pace with product change alerts and manages component obsolescence risks, periodically releases an informational sheet with some other eye-opening statistics worth taking a look at; you can view the 2019 sheet here.

Global Semiconductor Market Forecast

The global semiconductor market steadily increased throughout 2018 and, though 2019 was a slower year, semiconductor sales and innovation are expected to pick up in 2020. Processors, memory devices, networking, Micro-Electro-Mechanical Systems (MEMS) and other semiconductor components are expected to take off this year.

Graphics processing units (GPUs) and the memory market at large are forecast to grow this year. According to IC Insights, this year NAND flash memory and embedded MPUs are expected to grow, by 19% and 10%, respectively. DRAM is also expected to grow, by an estimated 12%, and DRAM prices are set to increase by 5% this year. According to Yole Développement, MEMS, actuators and sensors are also set to grow, from 2020 into 2024, as a result of technological advances in smartphones, automotive, industrial and biomedical production.

5G networking was slated to spread globally this year and to positively impact the tech and electronics industries. However, since its kick-off at the end of last year, 5G technology is spreading slower than expected and, due to the current Coronavirus outbreak, the rollout of this next-generation wireless standard may be disrupted.

IC Market Share: Which Markets & Product Categories Are On Top?

According to IC Insights, the communications IC market is continuing to surpass the computer IC market and will hold this position through 2023. Global growth in industrial automation is expected to strengthen, with the segment set to rise to an 8.7% share of the market in 2023. DRAM and NAND flash memory were the two largest IC markets last year and are projected to be among the three fastest-growing IC segments this year.

Additionally, the automotive IC market is likely to witness the fastest growth through 2023, however that still puts it at less than 10% of the total share of the market. The Automotive-Special Purpose Logic product category has been steadily growing over the past three years and it looks like it’ll continue in 2020. These updates have recently been reported by The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry.

Global Interconnects and Passive Components Get a Boost

According to Market Research Future, the major players in the interconnect and passive component markets, such as Cisco Systems, AVX Corporation, Molex, LLC, Panasonic Corporation, Ametek, Inc., Amphenol Corporation, Delphi Automotive PLC, Hubbell Incorporated, Hirose Electric Co., Ltd., and Hon Hai Precision Industry Co., are expected to witness 6% growth in their product lines through 2022, reaching more than $211 billion US dollars.

The most common end users of passive components and interconnects are equipment manufacturers, like OEMs, and most popular applications for the products will be consumer electronics, data processing, telecommunications, military and aerospace, automotive, industrial, and healthcare. Market Research Future’s regional analysis shows that Asia Pacific is dominating the market, as their higher manufacturing capabilities give them a competitive advantage. Asia Pacific is also the fastest growing market and is expected to continue to be through 2022. North America’s growing IT and telecommunication makes them the second biggest market for interconnects and passive components.

Buyers Facing Critical Supply Chain Challenges

Since the end of last year, issues, such as limited supplies and longer lead times, have been affecting buyers in the electronics industry. In 2019, Electronics Manufacturing Services (EMS) industry sales grew over 10% and while this sales trend is expected to continue, stress on supply chains and buyers could hinder growth. Key factors and issues impacting buyers currently are, but not limited to:

- Rising costs of raw materials

- Influxes of counterfeiting and counterfeit parts

- Rising international labor costs and reduced work forces, especially in China and other international manufacturing hubs

- Component shortages, IE: multilayer ceramic capacitors (MLCCs)

- Current tariff increases associated with the ongoing trade wars

- Companies trying to decrease the number of vendors on their AVLs

Relief Ahead on the Tariff Front for 2020?

Big changes in tariffs and trade occurred last year. Moving into this year, It remains unclear when the current trade war will end or what will happen next. In mid-December of 2019, a limited trade agreement between China and the United States was reached. This agreement canceled tariffs set to take effect, rolled back existing levies on Chinese goods, and secured purchases of U.S. farm goods. Though some feel that the agreement marked a turning point in the trade war, others are still skeptical about what the future holds. With this year being an election year, U.S-based manufacturers and companies will have to wait and see what the next steps will be.

Stay on top of the latest news, trends, and developments in the industry by subscribing to the Sensible Micro blog today.