In this month’s Sensible Semiconductor News Update, we’ll explore the factors that are shaping the future of the semiconductor shortage, how procurement professionals are responding, and the evolution of full chip design closure.

The Global Semiconductor Shortage: Understanding and Preparing for the Future

The last several years have upended the traditional operating rhythm of semiconductor fabs. While most fabs are used to operating at about 80% utilization, this ratio has fluctuated wildly since the start of the pandemic, leading to the shortages that experts now predict will extend into late 2023 or early 2024.

Shortages in the semiconductor industry aren’t new, but in the past they’ve typically been short lived. Previously, electronic component “allocation” (as shortages are termed in the industry) had always moved in cycles that lasted a matter of months or perhaps up to a year. The current level of disruption is completely unprecedented.

Because historical disruptions had never reached this scale, businesses have spent the past decade migrating toward “just-in-time” inventory strategies that are more cost-effective. However, the parade of unforeseen events that have rocked the global supply chain since the onset of Covid-19 have revealed the flaws of this strategy. In just the past couple of years, we’ve witnessed:

- A fire at the Renesas fab in Japan in March 2021, which took microcontroller production offline for 3 months.

- An ice storm that knocked out power across Texas in February of 2022, taking NXP, Samsung and Infineon fabs offline.

- A fire in Ukraine in early 2019 that disrupted the production of material used in packaging semiconductors.

- Labor shortages from reocurring lockdowns in China, which have delayed production throughout the pandemic.

- A cargo ship jammed in the Suez Canal in March 2021, blocking passage for over a week and impacting the delivery of chips in transit.

- 77 ships bottlenecked outside the Los Angeles and Long Beach docks due to staffing shortages in October 2021, which backed up shipping into the US for weeks.

This is a highly incomplete list. The war raging in Ukraine since the spring of 2022, for instance, has also had an enormous impact on supply chains worldwide. What we’ve learned is that just-in-time inventory is no longer viable.

New fabs are on the way in an attempt to ease some of the effects of the shortage. Foundries and manufacturers have started planning 29 new factories. 10 new fabs have broken ground in 2022 alone. However, it takes a year or two to construct a fab, and another year to install equipment and prepare for production. This is no quick fix.

Instead, manufacturers, OEMs, and procurement teams must move aggressively to face the challenge of extended shortages head-on. This is the time to identify alternate sources, locate distributor inventory, and carefully monitor the shifting sands of component pricing and availability for opportunities. This is where a well-connected distributor like Sensible Micro can help.

Top B2B Procurement Trends for 2022

The 2022 State of Business Procurement Report from Amazon Business offered some interesting takes on the trends, challenges, and priorities that characterize today’s procurement landscape.

The survey of 440 buyers across the U.S. revealed that “Procurement professionals continue to contend with a variety of challenges in a rapidly evolving landscape,” according to Amazon Business’ Aster Angagaw. B2B procurement teams are all-in on optimizing costs and increasing efficiency. One essential tool has been Smart Business Buying technology (also called e-procurement). These solutions empower buyers to find, compare, and purchase supplies that are not only within their price range but that also align with a set of core values.

The report further highlighted key findings that show the sway that increased online purchasing and less centralized office locations are having on procurement economics and processes:

- 91% of B2B procurement buyers prefer buying online.

- 84% say their organization plans to increase the purchasing budget reserved for diverse-owned businesses.

- 68% plan to make at least 40% of their purchases online by the end of 2022 — up from 56% in 2021.

- 58% now make purchases for delivery directly to an employee’s personal residence.

- 47% are managing bigger budgets this year versus 2021.

Sustainability is also top of mind this year for procurement professionals:

- 89% of B2B procurement buyers say if it was easier to identify sustainably-certified products, they would be more likely to purchase more sustainable products.

- 63% say improving sustainability in their purchasing practices is a top priority.

- 55% say it’s difficult to source suppliers that follow sustainable practices.

Annual budgets increases, while encouraging, are fairly routine. At the same time, the costs of goods continue to rise at a high rate due to record inflation. It’s likely that the majority of buyers continue to feel pressure to do more with less.

EDA Software Advancements Accelerate Chip Design Closure

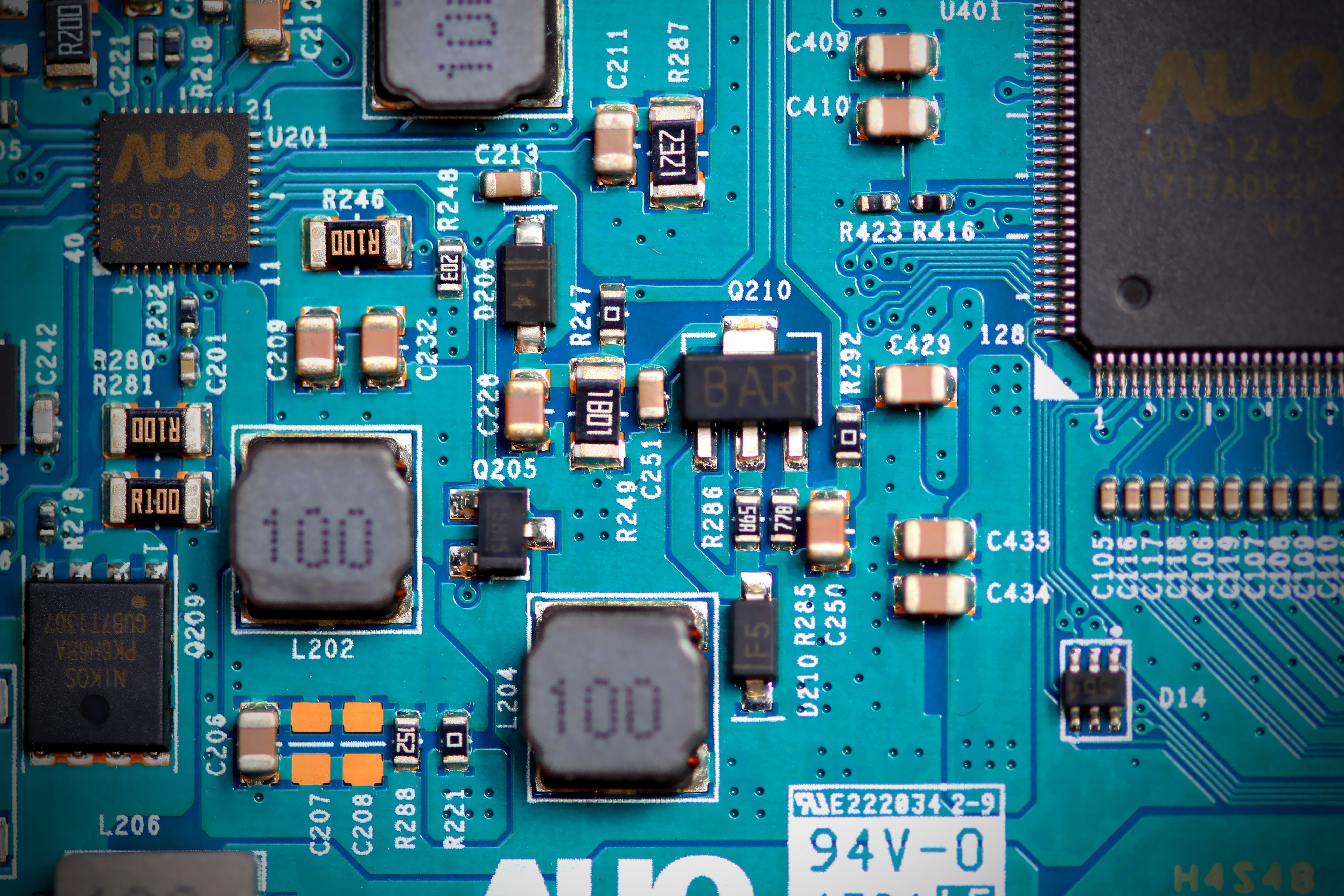

Engineers naturally intend to build the best possible chips, which can cause the closure process to take extra time. The process of developing a system-on-chip (SoC) is already a complex 3D design problem, but chips are growing increasingly more complex. The tens of billions of transistors in a modern chip already make it impossible to build them without EDA software assistance.

These intricate closures have become a significant bottleneck in getting final products to market. Full-chip and subsystem-level design closure can take engineers several days for each pass, in what is a tedious, iterative process. All told, it can take months to close out a chip design.

The next generation of EDA software promises to accelerate closure cycles until they take hours rather than months. Massive, parallel, and distributed system architecture makes it possible to multiply computing capacity for today’s more advanced designs, but even more important are integrations with other EDA software. Tools for placement, routing, and signoff, when all integrated with closure solutions, remove many tedious steps and speed up time-to-market.

Stay Up-to-Date on Semiconductor News With Sensible Micro

The Sensible team always keeps an ear to the ground for valuable industry insights and electronic component news. Our robust global network often enables us to access critical insights early, even before many OEMs and manufacturers.

Stay informed with Sensible Micro and prepare for imminent shifts in the semiconductor market — or the technologies that drive it!

News Sources: