The ongoing chip shortage shows no signs of relief in the near term, but not all electronic components industry players are taking the same approach to the crisis. In this month’s semiconductor news update, we’ll take a look at how (and why) Broadcom is bucking industry pressure to maximize production, what this may mean for you, and why your input is needed by the U.S. Commerce Department.

This is also the perfect time to look ahead to some exciting new architecture on the horizon from the Samsung Foundry — and to start planning for these “nanosheet” transistors.

Broadcom Tightens Strings on Supply Amid Global Chip Scramble

Broadcom, unlike many semiconductor producers, is in no rush to supply as many chips as possible. CEO Hock Tan suspects many companies of overbuying chips to build up emergency inventory. “People are building up a buffer that is at a certain level of panic buying," he says. In response, Broadcom has purposely sacrificed business to ship only “exactly what we believe the demand requires," and avoid building up excess inventory in the ecosystem.

If more broadly adopted, this strategy could mean more long-term, noncancelable orders for chips (to discourage stockpiling). Customers and chipsets with the most urgent needs may also be first in line, while others must wait — even if supply exists. Broadcom, for example, closed out quarter 3 with 16% more inventory than it started with, eyeing strong Q4 demand.

The White House Needs Your Input on Chip Supply Chains

The U.S. Commerce Department is gathering intel to spot the worst bottlenecks in the semiconductor supply chain and address them. If you’re a chip vendor, buyer, intermediary, or manufacturer, they want to hear from you.

Secretary of Commerce Gina Raimondo and National Economic Council head Brian Deese have already met with the key players in the U.S., including the Big Three automakers (GM, Ford, Stellantis), tech giants (Apple, Microsoft), top chip vendors (Intel, Micron), and leading foundries (TSMC, Samsung, Globalfoundries). Now it’s your turn.

The Commerce Department has called on all companies in the electronics supply chain to share info on inventory levels, demand, and delivery conditions. Your insights will help all buyers and manufacturers to improve their supply chain practices and anticipate future issues. Most importantly, however, they will help to direct the government’s efforts to provide relief now.

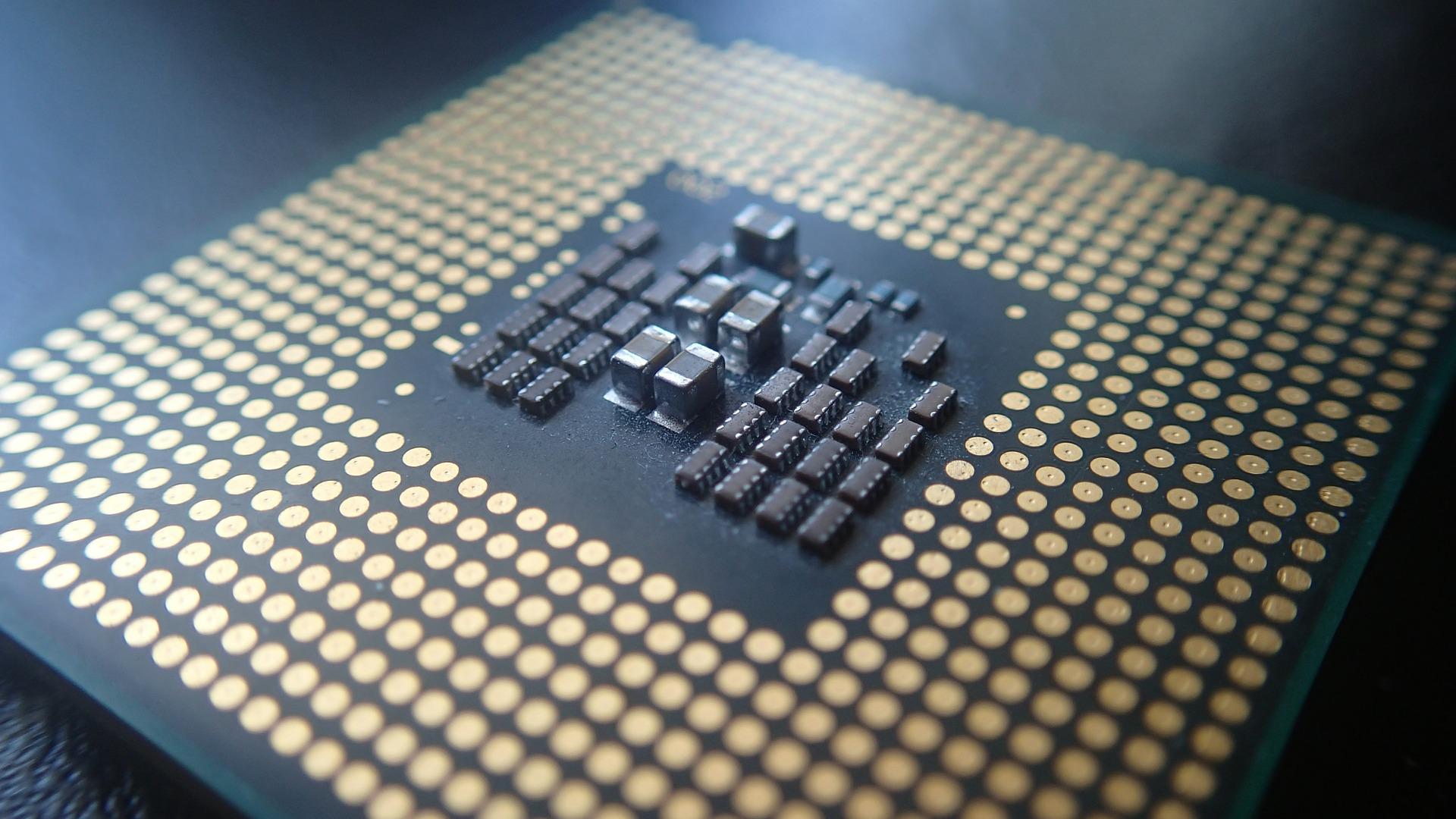

Samsung Foundry Delays 3-nm Node to 2022, 2-nm Due by 2025

Samsung's new 3-nm and 2-nm nodes will be based on "nanosheet" transistors, a new architecture that promises performance and power efficiency gains over the FinFET chips of the last decade. With less leaked current being wasted as heat, the 2-nm chip will provide 30% higher performance and 50% lower power than 5-nm FinFET nodes.

Siyoung Choi, president and general manager of Samsung Foundry, expects “the industry’s transition to 2-nm to be smooth thanks to the previous experience with 3-nm.” However, Samsung Electronics will not begin manufacturing chips based on the 2-nm node until late 2025. The 3-nm node was originally slated for the first half of 2021, but delays have now pushed that to early 2022.

Stay Up-to-Date on Semiconductor News With Sensible Micro

The Sensible team always keeps an ear to the ground for valuable industry insights and electronic component news. Our robust global network often enables us to access critical insights early, even before many OEMs and manufacturers.

Stay informed with Sensible Micro and get the tips you need to keep one step ahead of the market and buy before a shortage takes hold or a product sees increased demand.

News Sources: