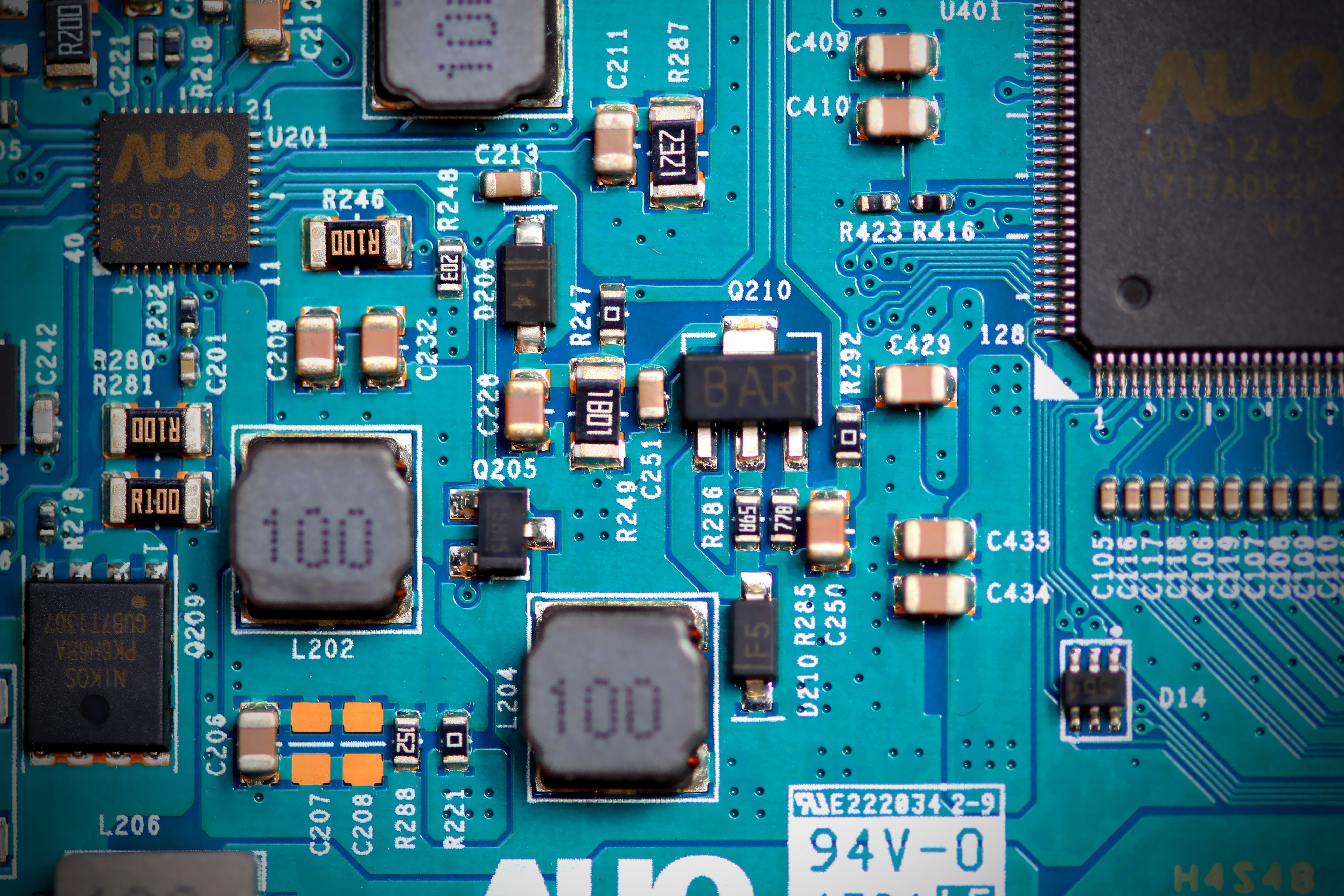

The worst of the pandemic-induced shortages may be behind us, but the industry will still feel the effects of these disruptions for several years. Nonetheless, growth is strong and new developments in regulations and memory R&D are reasons for excitement.

In this month's sensible semiconductor news update, we’ll take a closer look at the drivers behind encouraging semiconductor market growth early in 2022, the next frontier for memory, and a bill that could dramatically reduce the number of counterfeit electronic components arriving in U.S. markets.

Global Semiconductor Market Shows Robust Growth in 2022

Gartner reports that global semiconductor revenue is projected to grow 13.6% in 2022, including a $37B increase over the previous quarter’s forecast. While the chip shortage continues to concern certain sectors — especially in the automotive supply chain — inventory is recovering in smartphones and PCs with increases in semiconductor supply combined with a move into the off-season for those verticals.

Worldwide sales of semiconductors for Q1 of 2022 increased 23% over the same period last year (although still 0.5% lower than Q4 of 2021). Silicon wafer shipments are also up 10% in Q1 versus figures for last year. Healthier inventory in the memory market is a major driver of this revenue growth, with NAND now on track to reach oversupply by Q4, followed by DRAM in the second half of 2023. An aggressive migration from 4G to 5G this year is also expected to spur growth.

Infineon Plays into Global Space Race with Rad-Hard FRAM

Meanwhile, Infineon Technologies is riding a booming subset of the strong memory market into a new frontier. Their first 2-MB entry in a new family of radiation-hardened, serial-interface ferroelectric RAM (FRAM) rolled out in April 2022. These chips are designed to withstand the extreme environment of space for use in the next generation of spacecraft and satellites.

The latest chapter of the space age is marked by a rush to deploy swarms of satellites into low orbit, where they can beam broadband anywhere in the world, and even the development of civilian-carrying spacecraft. Companies are betting on the chips that best handle harsh vibrations, thermal challenges, and radiation that can damage circuits during launch and throughout decades spent outside of the earth’s atmosphere.

Off-the-shelf components won’t last, and reliability is at a premium. FRAM could serve as a replacement for serial NOR flash and EEPROM memories that are less tolerant of radiation and consume more power from the satellite’s solar panels.

SEERA Bill Combats Counterfeit Electronics in a New Way

A bill first introduced in 2019 as H.R. 3559 and reintroduced in 2022 as the Secure E-Waste Export and Recycling Act (SEERA) is now making its way through the U.S. Senate. The bill will combat counterfeit electronic components in a unique way: by requiring domestic recycling of untested, nonworking e-waste.

Historically, a large portion of U.S. electronic component waste flows overseas to China and other regions of the world. This waste has been a major culprit in the increased appearance of counterfeit goods in military and civilian electronics supply chains. Counterfeiters rely on exported e-waste as a material source, so expanding domestic recycling while reducing unsafe overseas disposal of discarded electronic parts could have an enormous impact.

Counterfeit microchips, primarily from China, threaten the reliability of wide-ranging technology essential to daily life and national security. If passed, SEERA could go a long way towards disarming that threat.

Stay Up-to-Date on Semiconductor News With Sensible Micro

The Sensible team always keeps an ear to the ground for valuable industry insights and electronic component news. Our robust global network often enables us to access critical insights early, even before many OEMs and manufacturers.

Stay informed with Sensible Micro and get the tips you need to anticipate the direction of the market and supply chain issues on the horizon.

News Sources: