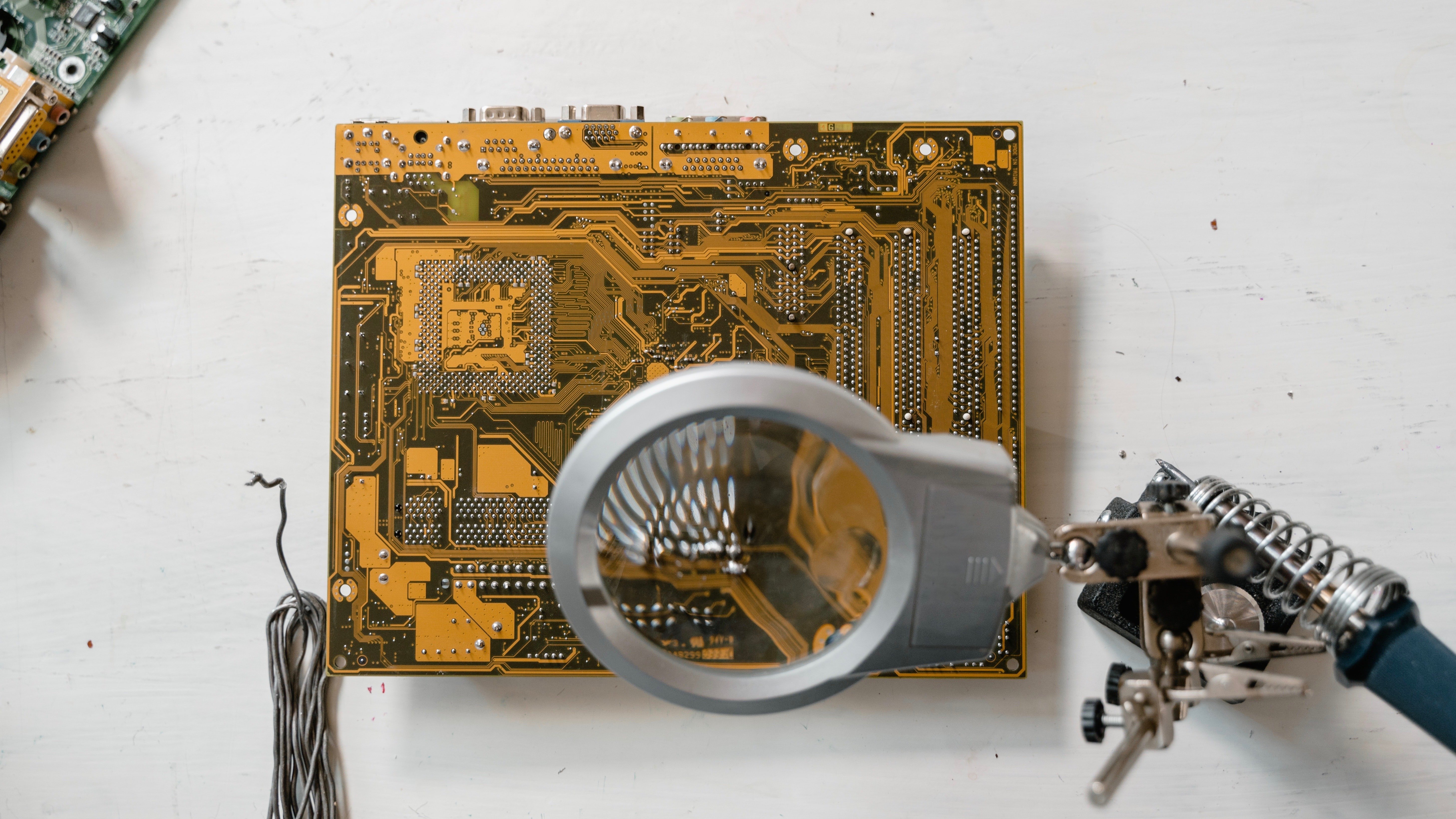

We’re closing in on 2022 and the automotive chip shortage has only gotten worse. An AlixPartners report puts the sales losses for automakers at $210 billion for 2021. According to CBS News, the pace of sales has dropped to it’s lowest rate since 2011. Dealers have 72% fewer vehicles stocked on their lots than in August 2019.

Oxford Economics' Mahir Rasheed attributes the crisis to “A storm of headwinds including the global semiconductor shortage, expiring fiscal support, and a spending rotation towards services will preclude sales from returning to their early 2021 pace." Many other factors were also in play, including a lockdown at the Vietnamese assembly plants, the Taiwanese drought, the Texas storm that hit Samsung’s Austin facility, and a major fire at Renesas’ Naka fabrication plant.

It could be early 2023 before the automotive chip shortage eases, the supply chain catches up with backlogged orders, and dealers are able to build up a regular inventory.

What Are Automakers Doing About It?

Toyota decided to slash production by 40% in Japan for 60 days, starting with September 2021. That same month, GM idled almost all of its North American plants. Shutdowns and cutdowns are only part of the story, however. Major brands are also getting creative to cope with the reality that chips aren’t going to be back in abundance any time soon.

GM has begun selling some full-size pickups with no automatic stop/start system and Ford has taken a hard look at shipping incomplete cars to the dealer’s lot, where the dealer can install missing chips (once the next shipment arrives). Other brands are walking back quality of life features that have become present-day standards:

- Nissan has left navigation systems out of their vehicles by the thousands

- Ram stopped offering 1500 pickups with standard “intelligent” rearview mirrors

- Renault eliminated the big digital screen behind the Arkana SUV’s steering wheel

With demand remaining high, there is virtually no pressure for automakers to offer meaningful discounts on their vehicles, even with the reduction in features (GM customers did get a $50 credit on their trucks). Most vehicles are still selling above MSRP.

What Does It Mean For You?

Entry-level cars are gradually being abandoned for bigger and pricier models. This is because it’s more profitable in a challenging semiconductor market to prioritize the vehicles with the highest profit margins. Those smaller and more economical vehicles will lean more on the rental and subscription service markets, and in fewer numbers. Any company building parts for OEMs or their Tier-1 suppliers should plan accordingly and focus growth efforts on components for the larger vehicle pipeline.

How Can I Get Through the Automotive Chip Shortage?

Automotive chip capacity is unlikely to catch up with demand in the short term. In light of this, many leading companies have established “dedicated war rooms that combine their supply and demand intelligence to create greater transparency,” per McKinsey. The research firm recommends open communication and joint discussions between the OEM, its tier-one suppliers, and semiconductor suppliers to align the goals of all involved.

In addition to transparency in the supply chain, McKinsey offers these strategic ideas to make the best of a bad situation and also address the long-term problem:

- Offer extra payments to expedite wafer production (if capacity is less than 5% of production volume)

- Replace back-ordered automotive components with more abundant feature-rich units. The worst shortages are on the lower end chips.

- Consider using consumer-grade chip sets, which have more robust quality testing.

- Make more binding up-front volume commitments (perhaps 6 months on a chip-set level)

- Institute more balanced risk-sharing plans

- Consider selective investments in supply-chain resilience (dual-source manufacturing)

Component purchasing still relies heavily on traditional channels like phone calls, emails, and spreadsheets. This creates undo stress and very little agility when a company must procure thousands of parts on a market with hundreds of sellers.

One final method for circumventing the worst of the automotive chip shortage is to begin purchasing from a resilient hybrid distributor. Sensible Micro leverages a diverse network of global suppliers from authorized, independent, and factory direct lines to help you locate the parts you need, when you need them, and keep track of everything in a convenient online portal.

Our comprehensive web portal puts all relevant info on the components you’re purchasing in one place. Access convenient tracking information, QA reports, hi-res photos, detailed specifications, and more in real-time and get rid of the guesswork. Get in touch with Sensible Micro today to find the parts you need — fast.