In this month’s electronic components news:

- The global microchip shortage continues to disrupt automotive production and sales.

- New pullbacks are happening across North America, Europe, and Asia as unstable supply chains strain automakers worldwide.

- While the auto industry scrambles, researchers make strides in using AI for smarter EV batteries.

- Mazda’s North American EV production plans

- A new partnership to create a sustainable titanium supply chain in the U.S.

Here is the roundup of what’s making news in the electronic components industry with this edition of Sensible Micro’s semiconductor news.

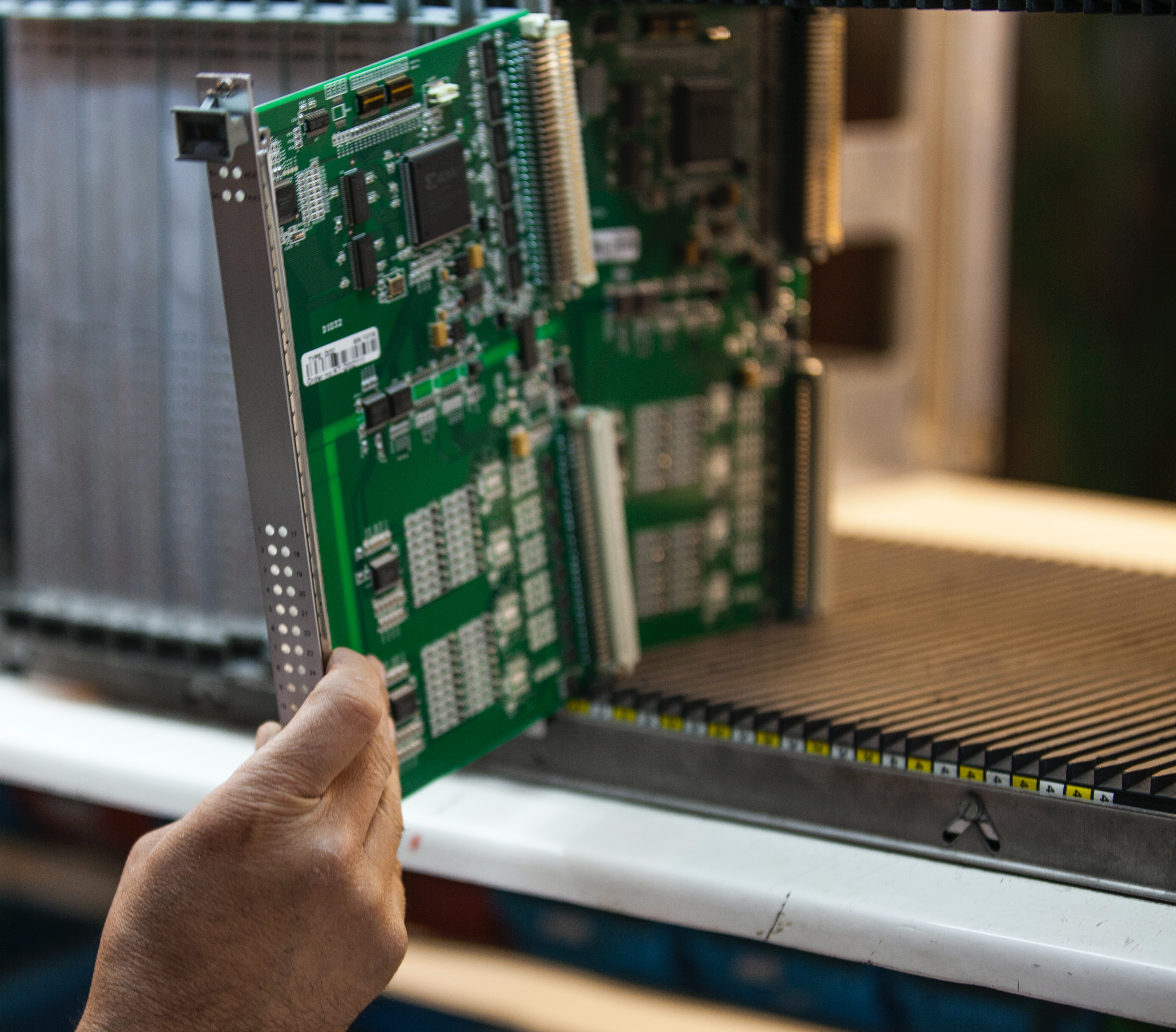

Auto Industry Seeing More Production Cuts Amid Microchip Shortages

More than 1.2 million vehicles have been sidelined so far in 2023.

Amid the continuing microchip shortage, new production pullbacks are happening globally. North American automakers are still coping with inadequate deliveries of chips. European factories are feeling an even bigger hit. While production lines in China and other Asian markets are experiencing a less severe setback.

Continued Instability in Supply Chains for Electronic Components

Overall, the demand for semiconductors has grown dramatically over the past few years. Smartphones, evolving technology in automobiles, high-performance computing, AI, 5G, and IoT devices have all driven demand. Industry reports put the global semiconductor market forecast at a 12.2% annual growth rate through 2029.

Demand has created significant chip shortages in key industries. Yet, others are now sitting on excess stock as consumer demand declines.

Automotive makes up 10% of the global semiconductor demand and is projected to increase to 15% by 2035. Several automakers, most notably GM, urged manufacturers to shift capacity from other sectors to overcome shortages for auto companies, but so far, manufacturers have declined.

David Loftus, CEO & President of the Electronic Components Industry Association (ECIA), recommends companies take several proactive steps to smooth supply chains, including:

- Diversifying suppliers and distributors to access a broader range of products.

- Improving demand forecasts and aligning inventory accordingly.

- Strengthening current supplier relationships

- Proactively reserving production capacity (where available)

- Investing in additional inventory to overcome disruptions.

Researchers Turn to AI for Smarter EV Batteries

Researchers at the University of California, San Diego, have developed a new AI system called M3GNet to accelerate the discovery of novel materials for next-generation lithium-ion batteries. The AI screens potential electrode and electrolyte materials to predict their properties before synthesis, compiling the results into a searchable database.

By predicting material behaviors, M3GN enables scientists to rapidly identify promising candidates for safer, higher-energy lithium-ion batteries. The researchers believe this high-throughput computational materials discovery approach could significantly shorten development timelines for advanced battery technologies.

Mazda Gears Up for North American EV Production

Mazda has announced plans to manufacture EVs in North America, joining several other automakers. Automotive News reports that Mazda plans two different types of electric vehicles. The first will be an EV based on an existing architecture that also allows for ICE and hybrid powertrains. The second will be a dedicated EV.

While both products will begin production in Japan, production in Mexico could take place as early as 2025-2027.

Mazda also plans to ramp up production of a hybrid version of the CX-50 at its Huntsville, Alabama plant, where it shares a joint facility with Toyota.

Partnership to Produce 100% Recycled Titanium Supply Chain

Aperam Recycling and IperionX are partnering to create a low-carbon 100% recycled titanium supply chain in the US. ELG will provide scrap titanium for recycling. IperionX will use the recycled material to create low-carbon metals as part of a push for a more sustainable supply chain.

Since the Russian invasion of Ukraine and constant discussions about sanctions, titanium supplies have been uncertain at best. For example, as much as 65% of the titanium used by Airbus typically comes from Russia. Titanium production in China has increased significantly. It is now the world’s largest producer, but there are continued concerns in the EU and North America about tying more production to Chinese entities amid global tensions between China and the West.

Stay Up-to-Date on Semiconductor News With Sensible Micro

The Sensible team always keeps an ear to the ground for valuable industry insights and electronic component news. Our robust global network often enables us to access critical insights early, even before many OEMs and manufacturers.

Stay informed with Sensible Micro and get the tips you need to prepare for the future.