There are encouraging signs of an industry emerging from the worst of the disruptions over the past two years. However, the public health crisis won’t quietly retreat into the night, as shown by recent lockdowns in China, and other disruptions continue to brew in the beleaguered freight and logistics sector.

In this month's sensible semiconductor news update, we’ll take a closer look at the product categories impacted by forecasted ups and downs in the electronic components supply chain.

COVID Still a Factor as Lockdowns Impact Manufacturers in Shanghai

Mid-March lockdowns in Shanghai have had a severe impact on Tesla and other major manufacturers utilizing or producing semiconductor technologies. Unexpected spot lockdowns in Shanghai laid a direct hit on a maker of semiconductor process equipment, ACM, including closing their administrative and R&D offices in Zhanjiang (in the Pudong district of Shanghai) for several weeks.

All indications show that normal operations will resume soon, and Tesla is also roaring back "with a vengeance." However, the lockdowns did not come without a price. Covid continues to prove its disruptive impact on the electronic components industry, significantly slashing ACM’s forecasted revenues for 1Q2022, which had not anticipated COVID-19-related limitations. Plan ahead for delays on products made in these regions of China in the near-term, and take this as a sign that COVID-19 may continue to impact production throughout 2022.

Microcontrollers Are Back And Booming After 2021 Turnaround

The 2020 year had marked a 2% fall in the MCU market due to shortages, shutdowns, and other challenges of the outbreak year. The numbers are finally in on 2021, however, and the microcontroller market climbed by 23% to a record-high $19.6B. This strong rebound brought the average selling price up by 10% to USD 0.64 — the exact average ASP of pre-Covid 2019. In other words, microcontrollers are back.

Not only that but the MCU market is expected to experience an increase of 6.7% CAGR from 2021 to 2026, a glowing forecast that projects strong sales and demand in the coming years. The automotive industry has had a major impact on the slump and the ensuing boom, as automotive systems make up a little over 40% of microcontroller sales. The fluctuation in the availability of automotive-grade chips has swung the market wildly, but everything is looking up and MCUs are enjoying their biggest sales increase in 25 years.

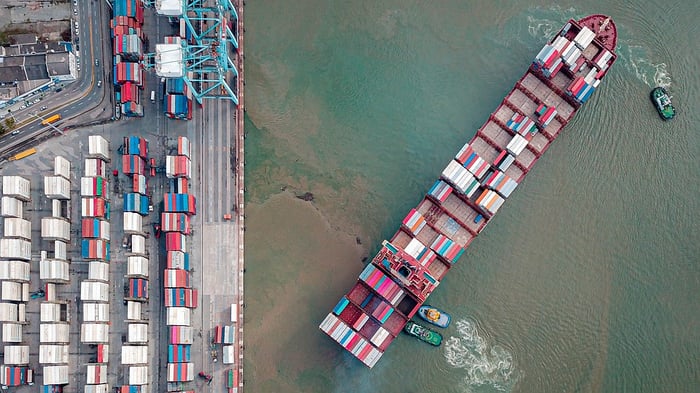

Possible Dock Worker Strike Could Worsen Supply Chain Disruptions

The International Longshore and Warehouse Union (ILWU) contract expires at the end of June 2022. There are rumblings of a possible dockworker strike, which would impact more than 22,000 union employees at 29 ports on the U.S. West Coast, including nearly 75% of the union members at the ports of Long Beach and Los Angeles — the main gateways for shipments to the U.S. from Asia.

This event could prove a catalyst in renewed disruptions for ocean freight and logistics around imported electronic components. With overseas factories playing a critical role for OEMs in the states, a labor impasse would bring operations to a grinding halt.

Prepare for the possibility of floating traffic jams, aggravated shortages, and continue increases in already-inflated pricing for consumer goods.

Stay Up-to-Date on Semiconductor News With Sensible Micro

The Sensible team always keeps an ear to the ground for valuable industry insights and electronic component news. Our robust global network often enables us to access critical insights early, even before many OEMs and manufacturers.

Stay informed with Sensible Micro and get the tips you need to keep one step ahead of expected shortages and phaseouts that are coming in 2022 and 2023.

News Sources: